IMPACT INDEX

The IMPACT Index is a survey about the economic impact of incubators, accelerators, coworking spaces, and other types of entrepreneurship centers in communities across the United States. This page contains initial visualizations of the data collected thus far. The majority of respondents representing the entrepreneurship centers serve in senior management positions. A new intake cycle for the last fiscal year is currently open.

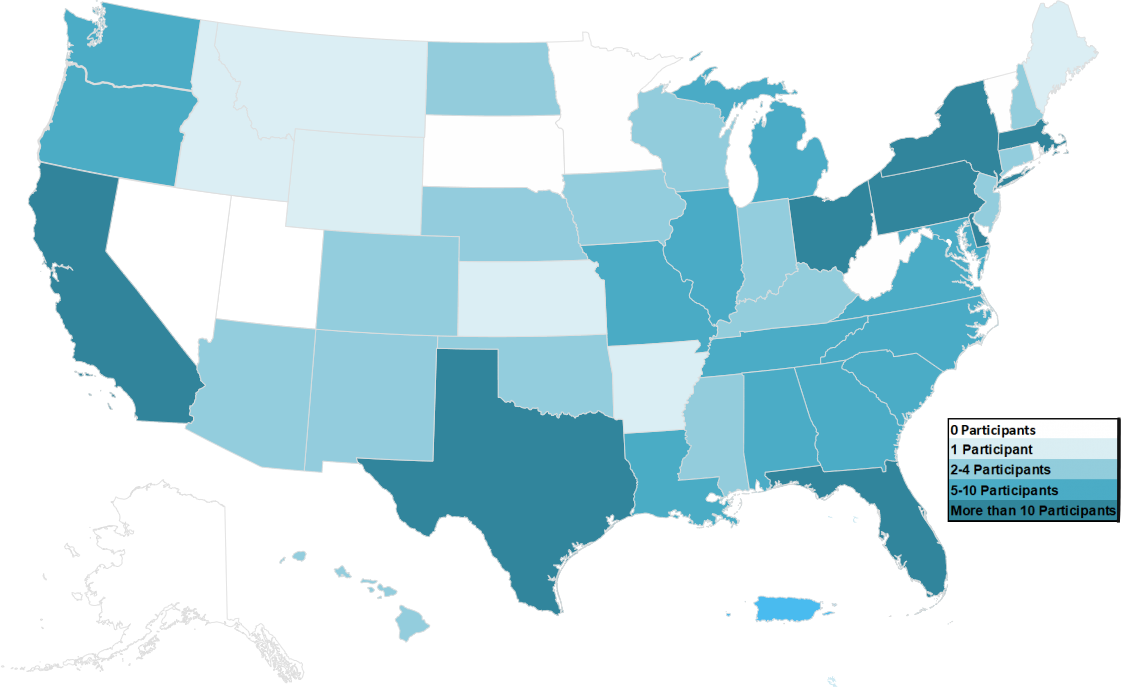

This report includes data from 248 participants.

While there are 248 complete responses, sample sizes for individual analyses are shown below (n).

When using the filter feature, there may be a delay in page loading.

This work was prepared by InBIA and UCF using Federal funds under award ED16HDQ3120001 from the Economic Development Administration, U.S. Department of Commerce. The statements, findings, conclusions, and recommendations are those of the authors and do not necessarily reflect the views of the Economic Development Administration or the U.S. Department of Commerce.

CENTER CLIENT METRICS

The IMPACT Index survey is a reflection of the impact that entrepreneurship centers have on US small businesses or entrepreneurs considering starting a company. The following survey questions asked entrepreneurship centers across America how their recent, as well as graduate, portfolio companies are performing in terms of revenues, investments or grants obtained, jobs created, and more.

COMPANY REVENUE REPORTS These graphics provide the combined revenues (in USD) for all the companies that participated in a particular EC’s program. The graphs are segmented by since center inception for a time-series view and during fiscal year 2016.

Key Questions

- How does my center’s client revenue compare to other organizations in the same region?

- How does the revenue generated by EC clients in rural areas compare to urban areas?

COMPANY INVESTMENT REPORTS The investment and associated valuation culled by client companies is a hot topic for ECs and can be used to demonstrate economic value and proof of concept. Understanding the level of investment achieved by EC-assisted companies links EC services and economic success. Survey participants were asked to share the amount (in USD) of equity capital obtained from non-center sources for all the companies that participated in their programs, both current and graduated, since center inception and during fiscal year 2016.

Key Questions

- Are my clients receiving similar investments to other ECs in my region?

- How does the equity and capital raised by EC clients in my region compare nationally and to other regions?

- What is the role of population density in outside capital received by client companies?

CLIENT JOB NUMBERS These figures answer the question “How many jobs are EC client companies creating?” Participants were asked to share approximately how many people (full-time and/or part-time) have been employed by their portfolio companies since center inception.

Key Questions

- Are my clients creating jobs like other ECs in the same region or population density?

- How does the job creation of ECs in one region compare to other regions? What about nationally?

- What external factors influence the number of jobs created by client companies?

CLIENT VOLUMES SERVED An important question in evaluating EC progress is “How many companies have you helped create and grow?” The survey asked respondents to share the number of clients they worked with during fiscal year 2016 and since the center was founded.

Key Questions

- Do I serve a similar number of clients to other ECs in my region? If not, why not?

- What is the role of industry focus in the creation of companies? Do certain company types require more resources?

TRACKING IMPACT AT THE EC LEVEL Data collection and analysis at the EC level is a critically important activity for ECs when seeking funding and demonstrating program efficacy. Participants were asked to share what data elements they tracked, ranging from equity raised to client revenues. Participants selected all that apply.

Key Questions

- Does my center collect sufficient data to demonstrate the work that we accomplish?

- What data elements are other ECs of my type collecting?

- How does the impact data collected by ECs vary by geography?

CENTER BACKGROUND

The following graphs demonstrate the diversity of the survey’s respondents, particularly by their location within the US, the population density of the area in which they are located, and the type of entrepreneurship center they most identify with. Additionally, this section contains information on center clients/tenants.

ABOUT THE ENTREPRENEURSHIP CENTERS

ENTREPRENEURSHIP CENTER CORPORATE STRUCTURE These figures answer the question “What corporate structures do entrepreneurship centers use?” The survey asked participants to select the organizational structure that best describes their organization.

Key Questions

- Does organizational structure differ across EC types?

- What are the advantages of each organizational structure?

- How does structure influence the types of program funding that ECs can obtain?

ABOUT CLIENTS/TENANTS AND FOUNDERS

INDUSTRY SEGMENTS REPRESENTED BY CLIENTS/TENANTS ECs serve client companies representing a multitude of industries. In some cases, the industry focus of the EC influences operations, facilities, staffing, and other important characteristics. The survey asked respondents to select up to three industry segments that best represented their ECs.

Key Questions

- How does industry vary with EC type?

- Do industry clusters exist within regions?

- Is my EC serving industries that are duplicated or unique in my area?

- What differences exist with respect to industries served across the rural, mid-density, and high-density divide?

ORGANIZATION FOCUS Many Entrepreneurship Centers have a demographic or geographic focus for their clientele. Participants were asked to select any particular demographics/representations of entrepreneurs/founders they specifically target or focus on serving. Participants selected all that apply. Selections included:

- College or university students

- Economically underserved populations

- Foreign/international companies

- Minority populations

- Native Americans

- Women

- Youth

Key Questions

- What types of ECs tend to focus on specific demographic groups?

- Are there other ECs in my region that are focused on similar demographic groups?

CENTER FINANCIALS

The following data visualizations explore the financial, staffing, and other operational elements that sustain entrepreneurship centers around the US.

OPERATIONS – FINANCIALS

ENTREPRENEURSHIP CENTER TOTAL ANNUAL REVENUES ECs vary in terms of funding and size. Survey participants were asked to indicate the average range of their organization’s annual revenue in USD, including money received via subsidies.

Key Questions

- How does organization revenue vary across EC types? Do certain EC types require more funding than others to operate?

- How does my EC’s revenue compare to that of other ECs of the same type?

*Note: this does not correspond to the revenue of client/member companies.

TYPES AND PERCENTAGES OF FUNDING/REVENUE SOURCES Maintaining a steady revenue stream is important for EC growth and stability. Participants were asked to indicate how much of their funding/revenue, including grants, was derived from the following methods:

- Membership/rent for office space

- Educational program offering participation fees

- Event and networking program revenues

- Corporate sponsorships/subsidies

- Donations

- Returns from client equity

- Grant funding from government agencies

- Grant funding from corporate/philanthropic foundations

Key Questions

- Does my EC receive funding from similar sources to ECs of the same type?

- How does the funding and revenue mix differ across service area densities?

- What differences in funding exist from a regional perspective?

TYPES AND PERCENTAGES OF GOVERNMENT-BASED FUNDING SOURCES The survey asked participants to break out their government funding sources as a percentage of the total. The survey asked “how much of your funding/revenue came from the following government-based sources?”

- Local government or economic development agencies

- State/province government or economic development agencies

- National government or economic development agencies

- Universities

Key Questions

- How does my government funding split compare to other ECs in my region?

- What are the advantages and disadvantages of national versus local funding?

ENTREPRENEURSHIP CENTER ANNUAL EXPENSES Understanding how ECs utilize their funding/revenue is important for benchmarking as well as identifying over- and underfunded areas. Participates were asked to indicate the range (in USD) of their total annual expenses. The results are generally consistent with the funding/revenue distribution.

Key Questions

- How do high impact ECs spend their funding/revenue?

- Do certain regions have different expense structures?

CATEGORIES AND PERCENTAGES OF ANNUAL EXPENSES This analysis answers the question, how do you spend your funding/revenue? Understanding that ECs strive to securing funding and generate revenue to fund their programs that drive impact. Expense categories captured in the survey include:

- Staff salaries

- Facility mortgages/leases/rent

- Utilities/internet/telephone

- Education or training for staff

- Legal and/or accounting

- Consultants/outside contractors

- Marketing

- Event costs

Key Questions

- How do the expense breakouts differ across regions and rurality?

- What differences in expenses exist across EC types? Do certain EC types require more staff?

- Is my EC over- or under spending in certain categories? What ramifications does this have for impact?

FACILITY OWNERSHIP The survey asked participants whether they own, lease, or share their brick and mortar center facilities. Owning a facility may confer stability to an EC, but can come with added operating costs.

Key Questions

- How does facility ownership differ across the country?

- What differences exist in facility ownership across EC types?

ENTREPRENEURIAL ECOSYSTEMS

The next section of the survey focuses on how the entrepreneurship centers relate to their ecosystems and beyond, specifically through their mentor program (if offered).

NETWORK AND INTERCONNECTEDNESS

Participants were asked whether they are affiliated with one or more local stakeholders, such as universities/colleges or private corporations.

ACADEMIC INSTITUTION PROVISIONS The survey asked about how their ECs benefited from affiliation with an academic institution, if applicable. Participants selected all that apply. Choices included:

- Space at no cost

- Discounted space

- Sole center funder

- One of many center sponsors

- Assets, education programs, or other client services

- Host an NSF-sponsored i-Corps program

- Center supports institution’s Technology Transfer Office

Key Questions

- How do the services provided by affiliate academic institutions vary by region?

- What role does geography and the local entrepreneurial ecosystem play in EC success?

ACADEMIC INSTITUTION FUNDING Funding is a benefit to affiliating with an academic institution. Survey participants were asked to share how their academic institution affiliation(s) help fund their center. Participants selected all that apply from the following options:

- Dedicated building/real estate

- Office or desk space for clients

- Program or operational funding

- Startup funding (grants, loans, or seed funding)

Key Questions

- What external factors influence the decision to pursue an academic affiliation for an EC?

- Do certain EC types tend to partner more with academic institutions?

- Is my academic affiliation providing services similar to others?

OFFERING A MENTOR PROGRAM Mentor programs are popular and impactful components of ECs across the country. The survey asked EC leaders whether they offer a mentor program, planned to within the next six months, or did not offer one.

Key Questions

- If your organization does not have a mentor program, why not?

- What barriers exist to developing, sustaining, and growing a mentor program?

- How does the presence of mentorship programs differ across regions?

MENTOR BACKGROUNDS Critical to the success of a mentor program is the quality of the mentors who advise EC client companies. Participants were then asked to identify the background of their mentors and to share how many mentors of each background type were in their mentor program. Background experience selections included:

- Experienced entrepreneurs, non-technical industries

- Faculty researchers

- Experienced entrepreneurs, technical industries

- Technical experts with small business experience

- Angel or venture capitalists

- Fortune 1000 corporate leaders

- Lawyers

- Bank or private equity executives

- Accountants

- Human resource professionals

Key Questions

- What kinds of mentors are most in demand at your EC or among ECs of your same type?

- What does each mentor type bring to the table in terms of driving impact for client companies?

- What role does rural or high-density location play in accessing mentors for an EC program?

ENTREPRENEURSHIP CENTER GOALS Entrepreneurship centers operate with specific goals for their clients and the entrepreneurial ecosystems in which they are located. The survey asked respondents to rate the importance of the following goals to their organization from “Very Important” to “Very Unimportant”:

- Achieving Welfare to Work

- Fostering Corporate Innovation

- Generating Investor Returns

- Commercializing University Research

- Encouraging Women and Minority Entrepreneurship

- Growing a Local Industry

- Job Creation

- Growing Local Entrepreneurial Culture

The results indicate that ECs pursue multiple goals simultaneously.

Key Questions

- Are goals different across EC types? If so, why?

- How do goals vary across geography and rurality?

- To what extent do organizational goals influence the daily operation of an EC?

CENTER OPERATIONS

The following section of the survey highlights the programming, services, and facilities/assets that America’s entrepreneurship centers provide to their entrepreneur clients/tenants.

STAFF, BOARDS, AND VOLUNTEERS

STAFFING INFORMATION Participants were asked to identify which of the following types of staff they employ:

- Senior level staff (directors and above)

- Full-time operations staff

- Part-time operations staff and/or contractors

- Paid mentors and/or entrepreneurs-in-residence

- Student interns

Key Questions

- What effect does staffing have on program impact?

- How does my client’s staffing compare to other ECs of the same type?

ADVISORY BOARD BACKGROUNDS Advisory boards can provide strategic and operational direction for ECs at all stages of development. The survey asked respondents to identify the backgrounds and experience of their board members, as well as how many of their board members had the following backgrounds:

- Angel or venture capital investors

- Bankers

- Corporate/industry experts, non-technical

- Corporate/industry experts, technical

- Experienced entrepreneurs or business owners

- Government or economic development leaders

- University leaders or researchers

Key Questions

- Is my EC deploying the optimal mix of board members to achieve our goals?

- If my EC does not have an advisory board, why not?

EDUCATIONAL/TRAINING PROGRAMS A critical element of ECs is the provision of programming and training designed to increase the impact of their client companies. Participants were asked which of the following educational or training programs they offered to their clients, as well as the frequency of each offering. Participants selected all that apply. Selections included:

- Business fundamental workshops

- Business plan development workshops

- Raising capital workshops

- Small Business Innovative Research (SBBR) or Small Business Tech Transfer Research (STTR) grant development workshops

- Technology education workshops

- Commercialization workshops for student/faculty

Key Questions

- How do the programs I offer compare to those offered by other ECs in my region?

- What differences exist in terms of program mix across EC types?

- In my experience, what are the most impactful EC programs?

EC-HOSTED EVENTS The survey asked respondents what types of events their ECs host for clients. The majority of respondents did host events for their clients, and the most popular events were networking. Participants selected all that apply.

Key Questions

- How do the types of events that my EC hosts compare to those in my region?

- How does event type vary by organization type?

- What is the goal of the events in terms of creating impact?

SEED FUNDING ACTIVITY

SEED FUNDING OFFERINGS Accelerator programs, as well as some other EC types, offer seed funding where participants in the program receive an equity investment in the company as part of program completion. Participants were asked if their center offers, or plans to offer within the next six months, an affiliate seed fund that provides cash in exchange for equity in startup companies served. Overall, seed funding was not a popular offering in the survey.

Key Questions

- What are the benefits and challenges of offering a seed funding program at my EC?

- How do I measure success of my seed funding program?

- What differences exist in seed funding models across those ECs that offer them?

SEED FUNDING SOURCE Seed funding as part of an EC program may have multiple sources. The survey asked participants that do have a seed fund to share the source of their seed fund funding. Selections included:

- Individual investors or program partners

- Corporate partners

- Public or government funds

Key Questions

- Is my seed fund funded in a similar way to other survey respondents? If not, why not?

- What are the benefits and challenges of each type of funder?

SEED FUND FREQUENCY Participants were asked how often they raise their equity funding for their seed fund, with frequency options ranging from multiple times per year to every five years.

Key Questions

- What accounts for the variety in responses in regards to fundraising frequency?

- Should I fund raise at different intervals?

AVERAGE SEED FUND FIRST INVESTMENT SIZE In addition to understanding who offers a seed fund, the survey asked for the amount of each seed investment made. Participants were asked to share their average investment size of the first round of financing invested in each company funded. The graphic demonstrates the wide variety of funding levels offered by the respondent ECs.

Key Questions

- How does funding vary across region?

- What role does industry have in the amount of seed funding provided to client companies?